In this digital age, where cryptocurrencies have taken the financial world by storm, there exists a fascinating realm known as crypto mining. Picture a scene far removed from traditional mines; instead of pickaxes and shovels, you’ll find vast data centres filled with an abundance of computing hardware. Welcome to the captivating world of crypto mining, where complex mathematical equations, hash rates, and a race against time intertwine to bring about the creation of new cryptocurrencies.

If you’ve ever wondered about the inner workings of cryptocurrencies and the intricate process of mining, then buckle up for a crash course in this remarkable field. We’ll delve into what crypto mining is all about, how it functions, and provide insights into recent market developments.

Key Takeaways:

- Crypto mining is the process of verifying and adding new cryptocurrency transactions to the blockchain by solving complex mathematical equations. Miners are rewarded with newly minted coins for their efforts, making it a crucial part of the blockchain puzzle.

- Mining hardware, such as ASICs for Bitcoin and powerful GPUs for other cryptocurrencies like Ethereum, plays a vital role in determining mining success and profitability. Electricity costs are a significant factor, and the adoption of renewable energy sources is becoming increasingly important for sustainability.

- Mining difficulty and hash rates directly impact competition, profitability, and network performance. Miners must constantly monitor and adapt their strategies to stay competitive in this dynamic landscape.

- While crypto mining offers potential for profit and financial freedom, it also presents challenges such as high entry barriers, energy consumption concerns, and market volatility. Careful consideration of the pros and cons is essential before entering the world of crypto mining.

Unveiling Crypto Mining: An Essential Piece of the Blockchain Puzzle

At its core, crypto mining is the process of verifying and adding new cryptocurrency transactions to the blockchain. To accomplish this, miners face an arduous task: solving highly complex mathematical equations. These equations act as puzzles, with miners competing to be the first to crack the code. Subsequently, the process begins anew. The more miners participating, the greater the potential profit.

This system is ingenious as it not only ensures the security of the blockchain but also rewards miners with the very cryptocurrency they help create.

Demystifying the Process: How Crypto Mining Works

At its foundation, crypto mining relies on robust computer hardware and copious amounts of electricity. However, the intricacies extend far beyond this basic understanding. To simplify matters, let’s decipher some of the common terminology, transforming you into a mining enthusiast in no time.

Hardware: The Backbone of Crypto Mining

In the world of cryptocurrency mining, hardware plays a crucial role in determining the success and profitability of mining operations. While it’s true that anyone with a regular computer can technically engage in mining, the reality is that turning a profit in today’s highly competitive market is a significant challenge. Let’s explore the specific hardware requirements for mining two prominent cryptocurrencies: Bitcoin and Ethereum.

Bitcoin Mining and ASIC Computers:

Bitcoin mining, the process of validating transactions on the Bitcoin blockchain, requires specialised hardware known as Application-Specific Integrated Circuit (ASIC) computers. These machines are purpose-built and meticulously designed to perform the complex calculations necessary for mining Bitcoin with unparalleled efficiency.

ASICs have distinct advantages over traditional computers in terms of mining power and energy efficiency. Their specialised hardware architecture is optimised specifically for mining, enabling them to perform the required calculations at remarkable speeds. This optimised efficiency translates into higher hash rates, the number of calculations a miner can perform per second, and increases the chances of successfully mining a block.

ASICs have revolutionised Bitcoin mining, gradually replacing traditional CPUs (Central Processing Units) and GPUs (Graphics Processing Units) due to their superior performance. They have become the go-to choice for professional miners who aim to maximise their mining capabilities and profitability. However, the downside is that ASICs are expensive investments, often requiring significant upfront capital. As a result, individual miners may find it challenging to compete with large-scale mining operations that possess the resources to deploy multiple ASICs.

Ethereum POW Mining and Powerful Gaming Computers:

In contrast to Bitcoin, Ethereum mining was still performed using more accessible hardware, such as powerful gaming computers. Ethereum previously relied on a mining algorithm called Ethash, which is resistant to ASIC mining. This characteristic allowed a wider range of individuals to participate in Ethereum mining using GPUs commonly found in gaming rigs.

ETH has now transitioned to a proof-of-stake (PoS) consensus mechanism, which is 99% more energy-efficient.

The computational demands of Ethereum mining primarily relied on the GPU’s processing power. Powerful graphics cards are capable of performing the necessary calculations required to validate Ethereum transactions. By harnessing the parallel processing capabilities of GPUs, miners could achieve competitive hash rates and stand a chance at earning mining rewards.

However, it’s worth noting that Ethereum mining had become increasingly popular, leading to heightened competition and rising mining difficulty. As a result, dedicated mining rigs, consisting of multiple high-end GPUs, emerged as a popular choice for serious Ethereum miners. These rigs are optimised for mining and can deliver even higher hash rates, increasing the likelihood of mining success.

Choosing the appropriate hardware for cryptocurrency mining requires striking a balance between investment costs, mining efficiency, and potential profitability. It’s essential to consider factors such as the initial purchase cost of the hardware, electricity consumption, cooling requirements, and the specific mining algorithm used by the cryptocurrency of interest.

As the crypto mining landscape evolves, it’s important to stay informed about the latest developments in mining hardware.

Additionally, keeping an eye on the mining difficulty of the cryptocurrency you intend to mine is crucial, as it directly impacts the level of competition and potential rewards.

Electricity: Powering the Mining Operations

In the world of cryptocurrency mining, electricity plays a vital role as it is the primary resource required to power the mining hardware and facilitate the computational processes. However, fluctuating energy prices and the environmental impact of electricity generation present both challenges and opportunities for miners. Let’s delve into the complexities of electricity in the context of cryptocurrency mining.

Fluctuating Energy Prices:

The profitability of cryptocurrency mining is heavily influenced by the cost of electricity. As energy prices fluctuate, so do miners’ profit margins. High electricity costs can eat into potential profits, making mining less economically viable, especially during periods of a market downturn or when electricity rates surge.

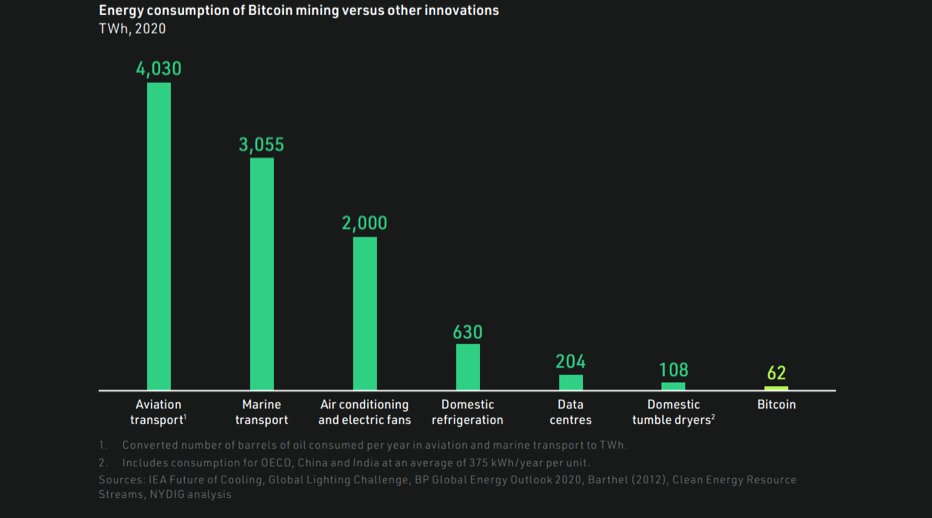

source: Energy Consumption of Bitcoin mining versus other innovations

The energy prices for mining operations vary depending on geographical location, local energy markets, government policies, and the availability of energy sources. Mining operations in regions with low-cost electricity, such as those near renewable energy sources or areas with subsidised electricity rates, tend to have a competitive advantage. Conversely, miners operating in regions with expensive energy tariffs may face significant challenges in achieving profitability.

Fossil Fuel vs. Renewable Energy:

Traditionally, mining operations have relied on electricity generated from fossil fuel sources like coal or natural gas. These sources are widely available and have been the default choice due to their accessibility and cost-effectiveness. However, the environmental impact of fossil fuels has sparked concerns about the sustainability and carbon footprint of cryptocurrency mining.

To address these concerns, professional mining companies have started to explore and implement alternative energy solutions. Many companies have taken proactive steps to establish renewable energy sources, such as wind, solar farms, and even volcanic energy in El Salvador to power their mining operations. By harnessing clean and renewable energy, these companies aim to reduce their carbon emissions and contribute to a greener future.

The use of renewable energy in mining not only helps mitigate the environmental impact but can also lead to cost savings in the long run.

Environmental Considerations:

The energy-intensive nature of cryptocurrency mining has drawn attention to its environmental implications. Concerns have been raised regarding the carbon footprint and energy consumption associated with mining operations. It’s estimated that global electricity usage for crypto mining exceeds the consumption of entire countries, raising questions about the sustainability and environmental responsibility of the industry.

To address these concerns, initiatives have been launched to promote sustainable mining practices. Some projects focus on developing more energy-efficient mining hardware, while others advocate for the increased adoption of renewable energy sources. Additionally, some cryptocurrencies, like Ethereum, are transitioning from proof-of-work to proof-of-stake consensus mechanisms, which drastically reduce energy consumption.

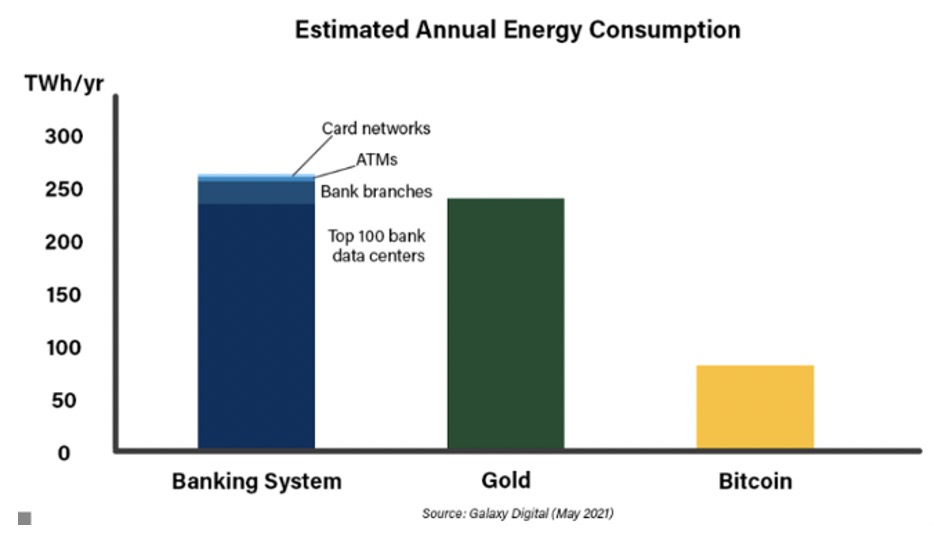

source: Bitcoin energy consumption is far more efficient and greener than todays banking system

As the cryptocurrency mining industry evolves, striking a balance between profitability and sustainability becomes crucial. Miners must carefully consider the cost of electricity, the environmental impact of their operations, and the potential regulatory requirements in their jurisdiction. Adopting renewable energy sources can reduce carbon emissions and position mining operations for long-term success as the world transitions to a more sustainable energy paradigm.

Furthermore, technological advancements and innovations in energy storage, grid management, and renewable energy infrastructure can drive down costs and make clean energy more accessible to miners. Collaboration between the mining industry, renewable energy providers, and policymakers can foster a more sustainable and environmentally conscious approach to cryptocurrency mining.

The cost of electricity and its environmental implications are significant considerations for cryptocurrency miners. While fluctuating energy prices pose challenges to profitability, the adoption of renewable energy sources presents an opportunity for sustainable and cost-effective mining operations. Striking a balance between economic viability and environmental responsibility is crucial for the long-term success and acceptance of cryptocurrency mining as a sustainable industry.

Crypto Difficulty: Navigating the Challenges

In the realm of cryptocurrency mining, “crypto difficulty” refers to the level of complexity involved in solving the mathematical problems necessary to add transactions to the blockchain. This difficulty rate is intricately tied to the total computational power, or hash rate, deployed across the network. Understanding the concept of crypto difficulty is essential for miners as it directly impacts competition, profitability, and market dynamics.

Understanding Difficulty and Hash Rate:

Crypto difficulty is dynamically adjusted by the underlying blockchain protocol to maintain a consistent block creation rate. The goal is to ensure that new blocks are added to the blockchain at a predefined rate, typically every few minutes. The difficulty is adjusted periodically based on the average block creation time over a specific period.

Impact on Competition and Profitability:

Higher crypto difficulty levels indicate increased competition among miners. As more miners participate in the network, the difficulty adjusts upwards to maintain the desired block creation rate. This adjustment reduces the likelihood of individual miners successfully mining blocks, leading to a decrease in profitability for those with limited computational power.

When mining difficulty rises, miners must invest in more powerful hardware or join mining pools to enhance their chances of earning rewards. This heightened competition and reduced profitability can be discouraging for small-scale miners or those with limited resources, as it becomes increasingly challenging to recoup their initial investments or cover operating costs.

Nevertheless, it’s important to note that higher difficulty levels often indicate a thriving and secure market. A growing number of miners joining the network signifies increased interest in the cryptocurrency, contributing to its overall strength and adoption.

Market Dynamics and Performance:

Conversely, during bearish market conditions, mining difficulty may decrease as miners exit the network, seeking more profitable ventures or temporary reprieve from operating costs. This adjustment helps balance the network and maintain a sustainable mining environment.

Monitoring and Adapting:

Cryptocurrency miners need to closely monitor changes in mining difficulty to make informed decisions about their mining operations. They should regularly evaluate their profitability, taking into account factors such as electricity costs, hardware efficiency, and the current difficulty level. By staying attuned to market dynamics, miners can adjust their strategies accordingly, whether that involves upgrading their hardware, joining mining pools, or exploring alternative cryptocurrencies with lower difficulty levels.

Staying informed about upcoming network upgrades, forks, or changes in the underlying mining algorithm is crucial. These developments can significantly impact mining difficulty, potentially rendering certain hardware obsolete or opening new opportunities for miners with specialised equipment.

Hash Rates: Unleashing Computational Power

In the world of cryptocurrency mining, hash rates play a pivotal role in determining a miner’s chances of success. When a miner attempts to solve the mathematical code required to validate transactions, a unique hash code is generated. The hash rate represents the number of calculations a miner can perform per second, directly influencing their probability of obtaining the mining reward.

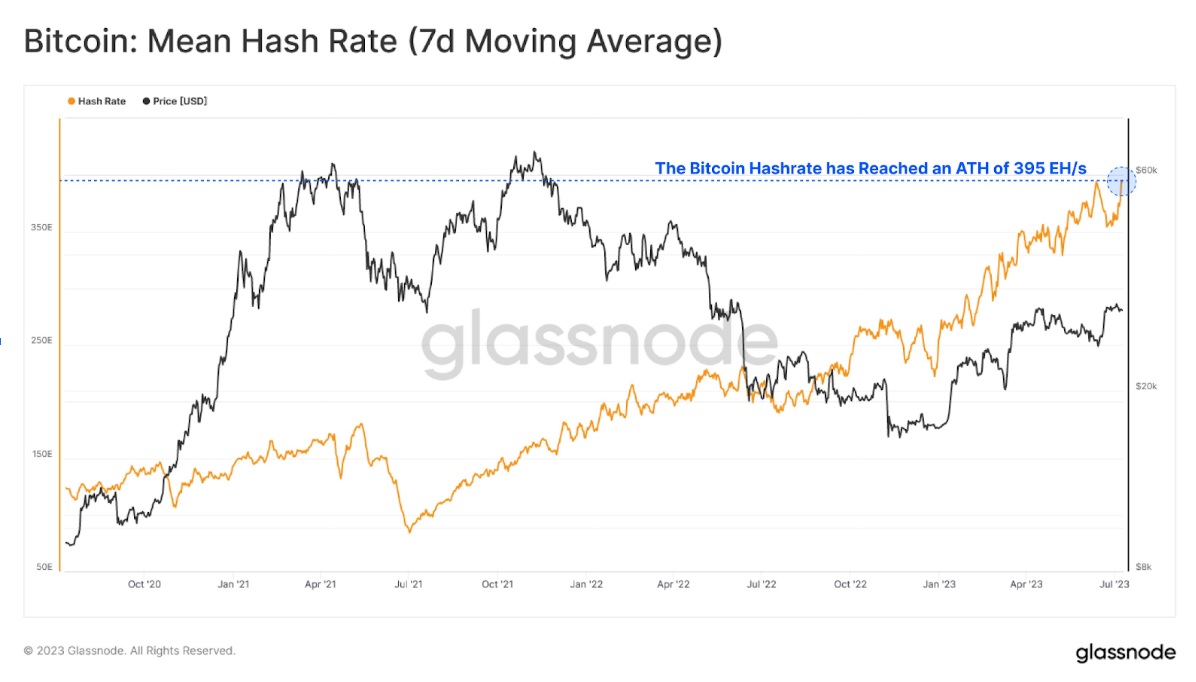

A higher hash rate, achievable through superior hardware and optimised configurations, translates into increased computational power. As a result, the hash rate serves as a key metric to gauge the network’s performance and mining efficiency.

The Significance of Hash Rates:

Hash rates are a fundamental measure of a miner’s computational prowess. The higher the hash rate, the more calculations a miner can perform within a given time frame. This increased computational power significantly enhances the miner’s chances of solving the mathematical puzzle and mining a block successfully.

Hash rates are influenced by various factors, including the mining hardware’s processing capacity, clock speed, memory, and efficiency. Miners often invest in specialised equipment, such as ASICs for Bitcoin mining or powerful GPUs for other cryptocurrencies, to maximise their hash rates. These purpose-built machines offer optimised architectures tailored to mining operations, enabling miners to achieve higher hash rates compared to general-purpose hardware.

The Impact on Mining Success:

Achieving a higher hash rate directly impacts a miner’s chances of securing mining rewards. Mining is a race to find a solution to a mathematical problem, and miners with higher hash rates have an advantage in this race.

In a competitive mining environment, where multiple miners are vying for the same reward, miners with superior hash rates are more likely to solve the mathematical problem before their competitors. This advantage allows them to add blocks to the blockchain more frequently, increasing their share of the mining rewards over time.

Network Performance and Optimisation:

The collective hash rate across all miners within a cryptocurrency network serves as a measure of the network’s performance and overall mining activity. A higher network hash rate indicates increased computational power and a thriving mining ecosystem. This is often a positive sign, suggesting a strong and secure network with active participation from miners.

The first bitcoin block was mined on January 3, 2009.

The network hash rate also plays a critical role in maintaining the security of the blockchain. A higher hash rate makes it more difficult for malicious actors to manipulate the blockchain or launch attacks. As the hash rate increases, the network becomes more resistant to potential threats, ensuring the integrity and immutability of transactions stored on the blockchain.

Optimising Hash Rates:

Miners are constantly seeking ways to optimise their hash rates to gain a competitive edge. This involves fine-tuning mining hardware settings, optimising software configurations, and exploring advanced techniques to maximise computational efficiency. Miners may also consider factors such as cooling systems to maintain optimal operating temperatures, as excessive heat can degrade performance and reduce hash rates.

Additionally, advancements in mining hardware and algorithmic optimisations continue to drive hash-rate improvements. Hardware manufacturers regularly release more powerful and energy-efficient mining equipment, enabling miners to achieve higher hash rates with lower energy consumption.

Monitoring hash rates, both at an individual and network level, is essential for miners to evaluate their mining efficiency, track performance, and make informed decisions regarding hardware upgrades or network participation.

The last bitcoin is estimated to be mined in 2140

Profitability: Balancing Costs and Rewards

In the realm of cryptocurrency mining, profitability is a critical factor that determines the success and sustainability of mining operations. For mining to be lucrative, the profits earned must surpass the costs associated with electricity and hardware. However, various factors, such as energy prices and equipment expenses, can significantly impact profitability. Let’s delve into the complexities of mining profitability and explore strategies employed by miners to enhance their returns.

Costs and Margins:

The costs of cryptocurrency mining primarily revolve around two key components: electricity and hardware as discussed above. Electricity costs account for the bulk of ongoing expenses, as mining operations require substantial amounts of power to operate the mining hardware efficiently. Fluctuating energy prices can significantly impact miners’ profit margins, particularly during periods of high electricity costs or surges in energy prices.

In recent times, soaring gas prices globally have put immense strain on miners’ profitability. The inflated cost of energy has eroded profit margins, making it more challenging for individual miners to achieve substantial returns. Miners must carefully evaluate their operational costs and assess the potential risks and rewards before engaging in mining activities.

Mining Pools:

To mitigate risks and enhance profitability, miners often join forces by forming mining pools.

By working together, miners can overcome the challenges posed by rising mining difficulty and optimise their collective mining efficiency.

In mining pools, rewards earned from mining are distributed among pool participants based on their contributed computing power. While joining a mining pool means sharing the rewards, it offers a more consistent and predictable income stream, especially for miners with limited computational resources. Mining pools can be particularly beneficial for individual miners who may struggle to compete with larger-scale operations.

The Rise of ASIC Hardware:

By utilising ASIC hardware, professional miners can achieve higher hash rates and computational power, increasing their chances of mining blocks successfully. ASICs have revolutionised the mining landscape, allowing miners to optimise their operations and maximise profitability. However, ASICs are expensive investments, which may pose challenges for individual miners with limited resources.

Strategies for Profitability:

To improve profitability, miners employ various strategies. They continuously monitor and analyse market conditions, such as cryptocurrency prices and mining difficulty, to make informed decisions about mining operations. Miners may consider factors like electricity costs, hardware efficiency, and expected rewards to assess profitability.

Regularly evaluating and optimising mining hardware, software configurations, and operational costs is crucial. Miners may explore energy-efficient mining hardware, upgrade existing equipment, or negotiate favourable electricity rates to improve profitability. Additionally, staying up-to-date with advancements in mining technology and industry trends can provide insights into emerging opportunities.

Ultimately, achieving profitability in cryptocurrency mining requires a combination of factors, including efficient hardware, optimised operations, favourable market conditions, and prudent cost management.

Recent Developments: Insights into the Ever-Evolving Crypto Mining Landscape

Like the broader crypto market, crypto mining is a dynamic and unpredictable landscape. To gain a better understanding of what lies ahead, let’s examine recent developments in the field over the past year.

Ethereum’s Merge: In September of the previous year, Ethereum completed its long-awaited merge, transitioning its system to a Proof-of-Stake mechanism. This transition replaced miners with validators who secure the network by staking a certain amount of cryptocurrency as a security deposit. While the merge had been planned for some time, concerns arose regarding the network’s security when validating new transactions. However, the upside of this development was a staggering 99% reduction in energy consumption for the entire Ethereum network, a significant step towards a greener crypto industry.

The FTX collapse and the SEC’s charges against multiple companies for unregistered securities unfolded. Bitcoin mining profits had plummeted by a staggering 70%, creating a sense of despair among miners.

Mining All-Time High: However, in an intriguing turn of events, Bitcoin has experienced a rally in the first 6 months of 2023. This price surge has enticed miners to return to the networks en masse. As a result, mining difficulty is currently at an all-time high. Are we on the brink of a bull run? Only time will tell! With new records already set, 2023 promises to be an eventful year for Bitcoin miners.

Potential for Profit: Mining cryptocurrencies can be highly profitable, especially during periods of high demand and price surges. Successful miners receive newly minted coins as a reward, which can appreciate over time. |

Decentralisation: Cryptocurrency mining contributes to the decentralised nature of blockchain networks. Miners play a crucial role in verifying transactions and maintaining the security and integrity of the blockchain. |

Financial Freedom: Cryptocurrency mining allows individuals to participate in a financial system outside traditional banking and governmental control. It offers the potential for financial independence and the ability to transact globally without intermediaries. |

Technological Learning: Mining introduces individuals to cutting-edge technologies such as blockchain, cryptography, and distributed systems. Miners gain a deeper understanding of these concepts and develop technical skills in computer hardware and software configuration. |

An Incentive for Innovation: The competitive nature of mining incentivises miners to develop more efficient and powerful mining hardware and software solutions. This drive for innovation can lead to advancements in technology that benefit the entire industry. |

An Incentive for Innovation: The competitive nature of mining incentivises miners to develop more efficient and powerful mining hardware and software solutions. This drive for innovation can lead to advancements in technology that benefit the entire industry. |

Participation in Consensus: By engaging in mining, individuals actively contribute to the consensus mechanism of a cryptocurrency network. They have a say in decision-making processes through voting or staking mechanisms. |

High Entry Barrier: Mining cryptocurrencies often requires substantial upfront investment in specialised hardware, such as ASICs for Bitcoin or powerful GPUs for other cryptocurrencies. The cost of equipment and electricity can be prohibitive for many individuals. |

Energy Consumption: Cryptocurrency mining consumes significant amounts of electricity. The energy-intensive nature of mining has raised concerns about its environmental impact, particularly when fossil fuels power the majority of mining operations. |

Complexity and Technical Knowledge: Mining can be complex and requires a deep understanding of blockchain technology, mining algorithms, software setup, and network security. The learning curve can be steep for newcomers and may involve ongoing technical maintenance and troubleshooting. |

Market Volatility: The value of mined cryptocurrencies is subject to market volatility. Price fluctuations can significantly impact mining profitability. Sudden drops in cryptocurrency prices can render mining operations unprofitable, especially if electricity costs remain high. |

Increasing Competition: As the popularity of cryptocurrencies grows, more miners enter the market, increasing competition. This competition drives up mining difficulty and reduces individual miners’ chances of earning rewards, making it harder to achieve profitability. |

Regulatory and Legal Challenges: The regulatory landscape for cryptocurrencies and mining is still evolving. Miners may face legal uncertainties, tax obligations, and potential regulatory changes that can affect the legality and profitability of their mining activities. |

Maintenance and Upgrades: Mining hardware requires regular maintenance and occasional upgrades to stay competitive. Equipment can become obsolete quickly as mining algorithms evolve, necessitating additional investments to remain profitable. |

Centralisation: The concentration of mining power in the hands of a few large-scale mining operations poses a risk of network centralisation. This concentration can undermine the decentralised nature of cryptocurrencies, potentially compromising security and censorship resistance. |

The Verdict: Crypto’s Journey Continues

By comprehending the inner workings of crypto mining, you equip yourself with the knowledge to navigate this ever-evolving terrain. Whether crypto is currently up or down, its potential remains immense, and staying informed is vital. Embark on an exciting journey through the realm of cryptocurrencies with us.

Joe Shew and The CCI Team

Australia’s Leading Crypto Educator