The beginning of decentralised finance, or DeFi, can be traced back to the emergence of blockchain technology and the creation of Bitcoin in 2009. Bitcoin introduced the concept of a decentralised digital currency that operates on a peer-to-peer network without the need for intermediaries like banks. This decentralised approach to finance challenged the traditional centralised banking system and inspired the development of new financial applications.

5 Key Takeaways:

- Decentralised Finance (DeFi) is revolutionising the financial landscape by leveraging blockchain technology to create transparent, peer-to-peer financial systems without the need for intermediaries.

- DeFi offers advantages such as reduced fees, increased accessibility, and empowerment of individuals to manage their finances directly.

- DeFi applications include peer-to-peer transactions, lending and borrowing, staking, yield farming, decentralised exchanges (DEXs), insurance, and derivatives.

- Despite its advantages, DeFi also faces challenges, including smart contract vulnerabilities, regulatory uncertainty, scalability issues, limited user experience, and market volatility risks.

- Total Value Locked (TVL) is a metric used to measure the amount of cryptocurrency locked up in DeFi protocols, reflecting the health and popularity of the DeFi ecosystem.

As blockchain technology advanced, developers started exploring its potential beyond cryptocurrencies. They realised that the underlying technology could be used to create programmable and transparent financial systems that operate without the need for intermediaries. This led to the birth of Ethereum, a blockchain platform that introduced smart contracts.

Smart contracts are self-executing agreements with the terms of the contract directly written into code.

They automatically execute transactions when predefined conditions are met, without the need for intermediaries. Ethereum allowed developers to build decentralised applications (DApps) that leverage smart contracts, opening up new possibilities for decentralised finance.

The concept of DeFi started gaining traction around 2017 when projects like MakerDAO and Augur emerged. MakerDAO introduced the concept of decentralised stablecoins, which are cryptocurrencies designed to maintain a stable value by using collateralised debt positions (CDPs). Augur, on the other hand, focused on decentralised prediction markets, allowing users to bet on the outcome of real-world events.

These early DeFi projects demonstrated the potential of blockchain technology to revolutionise various aspects of finance.

They offered alternatives to traditional banking services such as lending, borrowing, trading, and insurance, all without relying on intermediaries. This attracted attention and investment from both cryptocurrency enthusiasts and traditional investors.

Since then, the DeFi ecosystem has expanded rapidly, with new projects and protocols being developed. The growth of DeFi has been facilitated by the interoperability of blockchain platforms and the ability to create composability between different DeFi protocols. This means that different DeFi applications can interact and leverage each other’s functionalities, creating a more extensive and interconnected financial ecosystem.

DeFi protocols and applications now offer a wide range of financial services, including decentralised exchanges (DEXs), lending platforms, yield farming, liquidity provision, asset management, and more. These services provide users with more control over their financial activities, increased transparency, and potentially higher returns compared to traditional financial institutions.

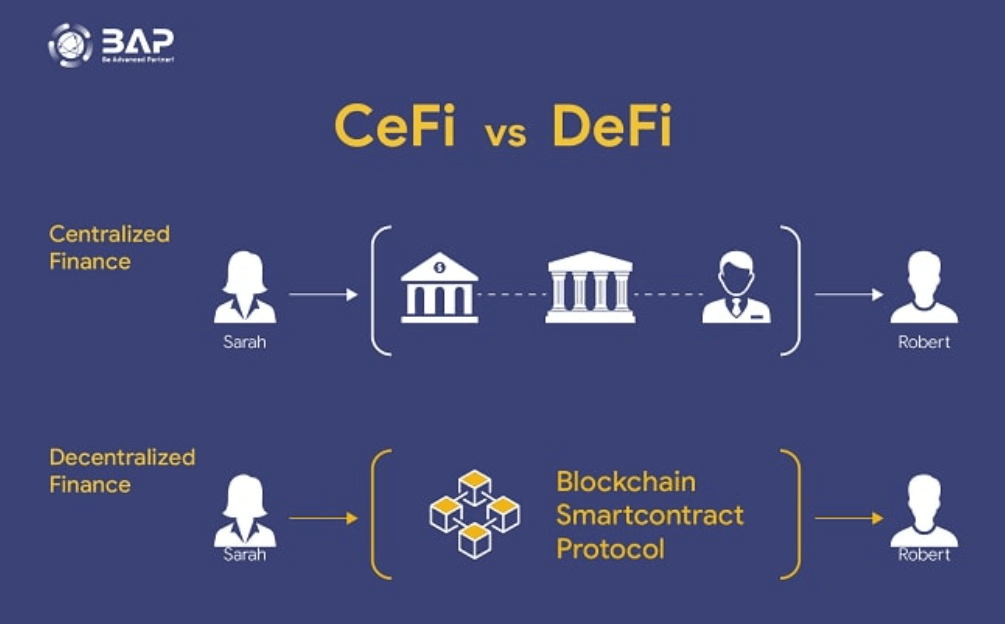

Contrasting Centralised Finance with Decentralised Finance (DeFi):

Centralised Finance:

The traditional financial system relies on centralised intermediaries, such as banks and financial institutions, to facilitate transactions. These intermediaries charge fees and oversee all financial activities, including loans, payments, and asset management. However, this model often limits accessibility, introduces delays, and incurs higher costs for users.

Decentralised Finance:

In contrast, DeFi eliminates intermediaries by leveraging emerging technologies, security protocols, and connectivity advancements. It allows individuals to directly access financial services through peer-to-peer interactions without needing a centralised authority.

source: CeFi vs Defi

The Inner Workings of DeFi:

Blockchain Technology:

At the heart of DeFi lies blockchain technology. Blockchain is a decentralised and immutable ledger that records transactions in blocks, which are then linked together to form a chain. Transactions are verified by network participants (nodes) through consensus mechanisms, ensuring security and transparency. Blockchain technology enables trustless transactions, as parties can validate and verify each transaction without relying on intermediaries.

dApps and Smart Contracts:

Decentralised applications (dApps) are software applications that run on top of blockchain networks and enable various financial activities in the DeFi ecosystem. These applications leverage smart contracts, which are self-executing agreements coded with predefined rules and conditions.

Smart contracts automatically enforce the terms of agreements, eliminating the need for intermediaries and ensuring the integrity of transactions.

Use Cases of DeFi:

Peer-to-Peer Transactions:

DeFi enables direct peer-to-peer transactions without intermediaries. Individuals can seamlessly exchange cryptocurrencies, assets, or value without relying on a centralised authority. This fosters accessibility, reduces transaction costs, and empowers individuals worldwide to participate in the global financial system.

Peer-to-Peer Lending and Borrowing:

DeFi has the potential to revolutionise lending practices through peer-to-peer lending platforms. These platforms leverage algorithms to match lenders and borrowers, facilitating the issuance of loans without traditional financial intermediaries. P2P lending in DeFi offers individuals greater access to credit, transparent interest rates, and faster loan processing. This can be a more efficient and cost-effective way to get a loan, and it can also be a way to earn interest on your money.

Staking:

Staking is a process of locking up your cryptocurrency to secure a network and earn rewards. This can be a way to earn passive income, and it can also help to support the DeFi ecosystem.Yield farming:

Yield farming is a process of depositing your cryptocurrency into a DeFi protocol in order to earn rewards. This can be a more profitable way to earn interest on your money than traditional savings accounts, but it can also be more risky.

Decentralised exchanges:

Decentralised exchanges (DEXs) allow users to trade cryptocurrencies without the need for a centralised exchange. This can be a more secure and transparent way to trade cryptocurrencies, and it can also be a way to avoid fees charged by centralised exchanges.

Insurance:

DeFi insurance platforms allow users to insure their cryptocurrency against theft or loss. This can be a way to protect your assets in case of an unexpected event.

Derivatives:

DeFi derivatives allow users to trade financial contracts on the blockchain. This can be a way to hedge against risk or to speculate on the future price of cryptocurrencies.

Advantages and Disadvantages of DeFi:

| Reducing Fees: Traditional financial systems often impose high transaction fees, making it costly for individuals to access certain financial services. DeFi, being built on blockchain technology, eliminates the need for intermediaries, thereby significantly reducing fees associated with transactions, lending, and borrowing. This cost reduction makes financial services more accessible and affordable for individuals worldwide, especially those who are unbanked or underbanked. |

| Empowering Individuals: One of the most significant advantages of DeFi is its ability to empower individuals with greater control over their finances. Through DeFi platforms, individuals can manage their assets, engage in peer-to-peer lending and borrowing, trade digital assets, and participate in decentralised governance. This level of empowerment allows individuals to bypass traditional gatekeepers, enabling them to make financial decisions and investments without relying on centralised authorities. |

| Enhanced Accessibility: Traditional financial systems often exclude large segments of the global population due to various barriers, such as geographical limitations, lack of documentation, or insufficient credit history. DeFi, built on blockchain technology, enables anyone with an internet connection to access financial services. This increased accessibility has the potential to bridge the financial inclusion gap, allowing individuals in underserved regions to participate in the global economy and unlock economic opportunities. |

| Transparency and Security: DeFi operates on a transparent and auditable blockchain network. All transactions, smart contracts, and balances are recorded on the blockchain, providing unparalleled transparency and reducing the risk of fraud and manipulation. Additionally, the use of cryptographic protocols ensures the security and privacy of individuals’ financial information. This transparency and security instil trust in the DeFi ecosystem, attracting more participants and accelerating its adoption. |

| Smart Contract Vulnerabilities: DeFi applications rely heavily on smart contracts, which are self-executing agreements running on blockchain networks. However, smart contracts are not immune to vulnerabilities, and coding errors or security flaws can lead to significant financial losses. High-profile incidents such as the DAO hack in 2016 and subsequent exploits have highlighted the need for robust auditing and security practices within the DeFi space. |

| Regulatory Uncertainty: DeFi operates in a relatively unregulated environment. While this allows for innovation and experimentation, it also presents challenges in terms of investor protection, compliance with anti-money laundering (AML) and Know Your Customer (KYC) regulations and the potential for illicit activities. As DeFi gains mainstream attention, regulatory bodies around the world are seeking ways to address these concerns, which may introduce additional compliance requirements and potential limitations on certain aspects of DeFi. |

| Lack of Scalability: Blockchain networks that underpin DeFi applications, such as Ethereum, have faced scalability issues, especially during periods of high demand. Network congestion and high transaction fees can hinder the user experience and limit the potential for widespread adoption. While various layer-two scaling solutions are being developed to address these challenges, achieving high throughput and low transaction costs remains a key hurdle for DeFi scalability. |

| Limited User Experience: DeFi applications can be complex and require a certain level of technical knowledge to navigate. The user experience often falls short of the polished interfaces and seamless interactions offered by traditional financial platforms. Improving the user experience and creating more intuitive interfaces will be crucial to attracting and retaining a broader user base. |

| Market Volatility and Risks: DeFi applications often involve trading and investing in digital assets, which are known for their volatility. The decentralised nature of DeFi platforms also means that there is no central authority or safety net to mitigate potential risks. Users must conduct thorough due diligence, assess the risks associated with various protocols, and be aware of potential smart contract vulnerabilities and market volatility. |

Total Value Locked (TVL) in DeFi:

Total Value Locked (TVL) is a metric that is used to measure the amount of cryptocurrency that is locked up in DeFi protocols. TVL is calculated by adding up the value of all the cryptocurrency that is deposited, staked, or loaned in DeFi protocols.

TVL is a good measure of the overall health of the DeFi ecosystem. A high TVL indicates that there is a lot of interest in DeFi protocols and that people are using them to store their cryptocurrency and earn interest. TVL can also be used to compare the popularity of different DeFi protocols. For example, if the TVL of MakerDAO is higher than the TVL of Compound, then this indicates that more people are using MakerDAO.

TVL is not a perfect metric, however. It does not take into account the volatility of cryptocurrency prices. For example, if the price of Ethereum goes up, then the TVL of DeFi protocols that use Ethereum will also go up, even if the amount of cryptocurrency that is locked up in those protocols does not change.

Here are some of the benefits of using TVL as a metric:

|

However, there are also some limitations to using TVL as a metric:

|

Looking Forward: The Promising Horizons of DeFi

Decentralised finance (DeFi) holds the potential to reshape the financial landscape by eliminating intermediaries, reducing fees, and empowering individuals with greater control over their finances. While DeFi is still in its early stages, it offers numerous advantages in terms of accessibility, transparency, and financial inclusion. As the industry continues to mature and regulatory frameworks evolve, the future of DeFi looks promising in revolutionising traditional financial systems and democratising access to financial services worldwide.

We genuinely hope you found this blog insightful. If you’re interested in fast-tracking your crypto success and mitigating any potential downsides, our team is here to support you. Feel free to reach out!

Joe and the CCI Team.