Investors are on edge for what a new regime of loosening monetary policy and rate cuts mean for short term price action of Crypto. While the consensus view is that we see turmoil in risk markets, we think it is valuable to explore the contrarian view in this forecast for a surprise rally in the event of an EARLY rate cut

The Federal Reserve and the Upcoming Rate Cut Decision

Market Scepticism

While the mainstream media suggests a delayed (Nov/Dec) or even absent rate cut in 2024, there is momentum building for an earlier cut. This view likely stems from a misinterpretation of the Fed’s data-dependent policy. The Fed has consistently emphasized that its decisions will be based on incoming economic data, particularly inflation.

Softening Inflation and Economic Data

Recent data signals a significant slowdown in inflation. The June Empire State Manufacturing Survey, (a key indicator), showed a sharp decline in inflationary pressures, with the Prices Received index reaching its lowest level since July 2023. This trend is expected to continue – we also saw June’s Core CPI inflation rate below 3% and CPI broadly drop to 3.3%.

Furthermore, broader economic indicators, such as Citi’s Economic Surprise Index and unemployment claims, also point towards a softening economy. This data suggests the Fed may be compelled to act sooner than expected

Investor Positioning and Optimistic Outlook

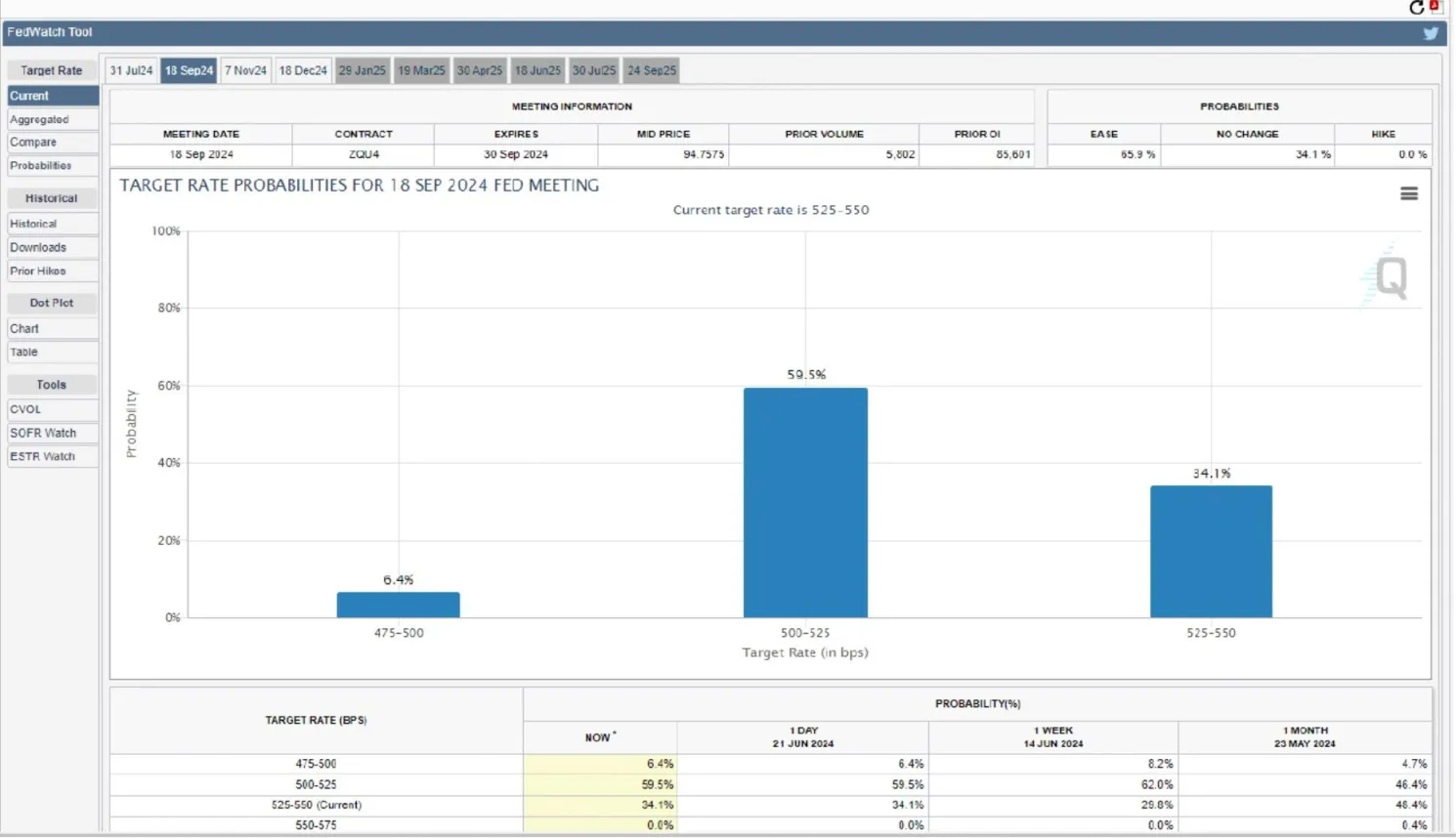

Currently, the market anticipates a first rate cut by September with a 65.9% probability. This is likely to increase as incoming data strengthens the case for a rate cut. This shift in sentiment could trigger a significant stock market rally throughout July and August and we anticipate that this will align with a upwards shift from Bitcoin’s long consolidation above 60k.

Portfolio Preparation for the Potential Rally

If we do get a rally in back end of July August, we think BTC and ETH will lead the charge via ETF flows with Crypto broadly getting a kick on the tailwind

Key Takeways:

- While a rate cut is anticipated by the market, the timing remains uncertain

- We believe the Fed will prioritize recent economic data indicating a slowdown.

- An imminent rate cut could trigger a substantial stock market rally.

- Our portfolio positioning reflects our optimistic outlook.

SAFELY CREATE WEALTH IN CRYPTOCURRENCY WITHOUT DAY TRADING, WASTING ENDLESS HOURS AND TAKING UNNECESSARY RISKS!

Discover How To Eliminate ALL Unnecessary Risks

Safely manage your assets and eliminate unnecessary risk, so you can be in full control and grow your investments.

Joe Will Reveal The PROVEN Investment Strategies

Proactively build out an investment strategy to allow the market to come to YOU. This is the same strategy his 7 figure profit clients use!

Learn How To Identify The Life-Changing Opportunities

With the proven blueprint that Joe and his clients have been using over the last 4.5 years to great success!

Understand 10 Mistakes Cryptocurrency Investors Make

If you want to be a successful cryptocurrency investor, you need to know these...

Some Other MUST KNOW Bonuses

Joe will pull back the curtain on some other MUST KNOW investor tips to minimising your risk and maximising your returns.

Disclaimer:

The information provided on this website is for general informational purposes only and does not constitute financial advice. It is essential to consult with a qualified financial advisor before making any investment decisions. Past performance is not indicative of future results. Investments are subject to market risk, and there is no guarantee of profits. Investing involves risk, including the potential for loss of principal. You should be aware of the risks associated with investing before making any decisions. The information presented on this website is not tailored to your specific financial situation or investment objectives. It is crucial to consider your individual circumstances and risk tolerance before making any investment choices.