Discover a Million Dollar Trader's

Secret Strategies With The

Quantum Profits Trading Course

Discover a Million Dollar Trader's

Secret Strategies With The

Quantum Profits Trading Course

How Our Course Helps You Achieve Your Goals

Learn a master trader’s secret to achieving over 90%+ profitable trades and 5% or more profits week after week!

- Achieve consistency in trading and build wealth with a proven system

- Maximise profits and minimise risks with a stress-free, efficient strategy

- Master the secret strategies to significantly grow your portfolio

- Boost your trading skills to avoid pitfalls and trade confidently

Key Features and Highlights of the Course

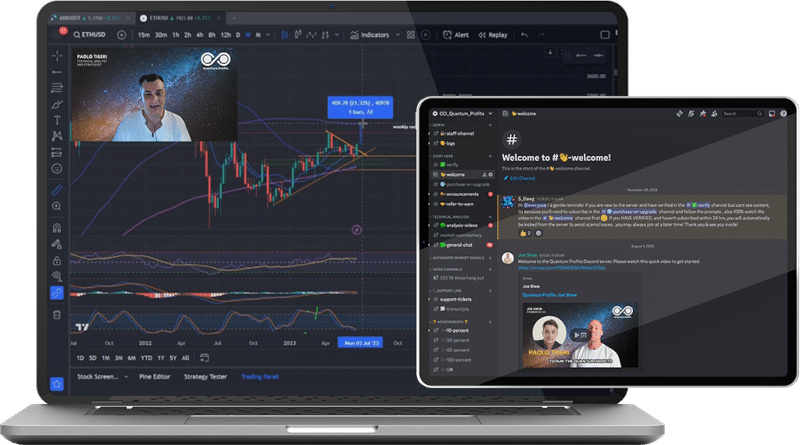

The Quantum Profits Trading Course is delivered by million-dollar traders with practical expertise, offering a hands-on learning environment

designed to help you achieve your goals effectively.

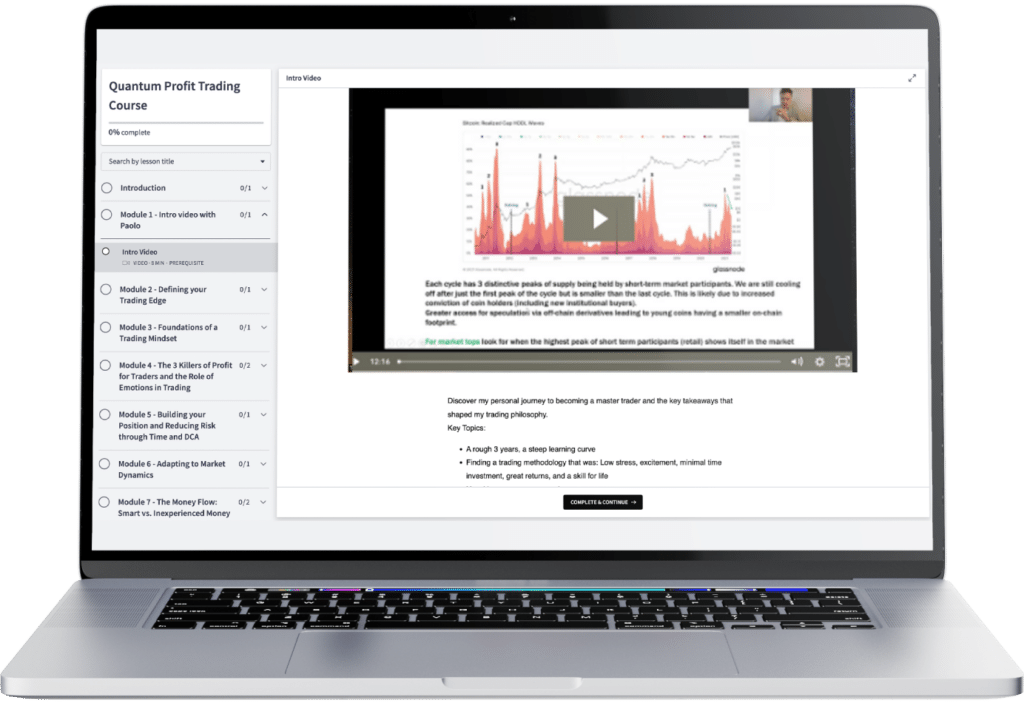

Course Format

- Self-paced modules with lifetime access

- Interactive assignments and quizzes

- Downloadable resources and guides

- Certificate of Completion

BONUS for the First 100 Registrants

- 1 Month Exclusive Access to Quantum Profits Trading Group

- 2 Times Weekly Live Q&A with Paolo Tiberi

- Interactive Informed Community Access

Melonie Taylor

AU

Melonie Taylor

AU

Petra

AU

CCI just keeps getting better and better, they are constantly updating their course content too. I recently joined up to Quantum Profits through CCI, and now I’m learning how to make life-changing amounts of money, fast. So now I feel safe and confident to make money FAST! Thanks for all your support through the years Joe, Sam and all the team.

Petra

AU

CCI just keeps getting better and better, they are constantly updating their course content too. I recently joined up to Quantum Profits through CCI, and now I’m learning how to make life-changing amounts of money, fast. So now I feel safe and confident to make money FAST! Thanks for all your support through the years Joe, Sam and all the team.

Jack Avenali

IT

I joined both their VIP program and been in the elite Mastermind for 2 years now, including Quantum Profits and I can guarantee CCI is much more than crypto education. The recent addition Quantum Profits is run by a person who is not scare to feel emotions, has an open heart and deeply understand the gap on how emotions triggers behavioural pattern in decision-making. He explains trading and trading psychology with a deep understanding of human behavioural patterns, emotions management and trading tools, the niche is he does it in a very objective way which is why I highly value Quantum Profits as learning resource.

Jack Avenali

IT

I joined both their VIP Program and been in the Elite Mastermind for 2 years now, including Quantum Profits and I can guarantee CCI is much more than crypto education. The recent addition quantum profits is run by a person who is not scare to feel emotions, has an open heart and deeply understand the gap on how emotions triggers behavioural pattern in decision-making. He explains trading and trading psychology with a deep understanding of human behavioural patterns, emotions management and trading tools, the niche is he does it in a very objective way which is why I highly value Quantum Profits as learning resource.

Thousand's of Paolo's Learners Worldwide,

With 95% of Students Seeing a Return on Their Investment Within 3 Months!

What Are The 5 Most Common

Challenges Traders Face?

- Market Volatility - Rapid price fluctuations can make it difficult to predict market movements, leading to potential losses despite analysis.

- Information Overload - Traders face overwhelming data and news, making it hard to filter relevant information and decide.

- Adapting to Market Changes - Markets are dynamic, influenced by economy, geopolitics, and technology, making strategies challenging.

- Over-reliance on Technical Indicators - Over-relying on technical indicators without considering context or fundamentals can mislead.

- Emotional Bias - Fear, greed, and other emotions can cloud judgement, leading to impulsive decisions that deviate from analytical strategies.

The Benefits of Taking

Quantum Profits Trading Course

1. Mastering the Million-Dollar Trader's Mindset

Learn the essential psychological tools that separate winners from losers in trading. From managing emotions to building a resilient trading mindset, you’ll develop the foundation needed to thrive in volatile markets.

2. Build and Refine

Your Trading Edge

Discover what makes a trading edge powerful and how to create one that aligns with your personality and goals. Achieve consistent profitability by combining strategy, simplicity, and adaptability.

3. Leverage Time and Trends for Maximum Profitability

Unlock the power of trend identification and time-based strategies to maximise your trades’ success rate. Master techniques to enter, exit, and scale positions with precision.

4. Develop a Lifetime Strategy for Trading Success

Make trading a lifelong skill by building confidence, consistency, and a structured approach for long-term growth while avoiding pitfalls.

Who Is This Course For?

Who Is This Course For?

Ideal learners include beginners needing basics, intermediates seeking advanced strategies, and experts looking for complex techniques to improve their skills.

- Aspiring investors looking to grow their portfolios

- Crypto enthusiasts seeking expert strategies

- Entrepreneurs exploring digital finance opportunities

- Traders wanting consistent profits and stress-free decision-making

Pricing Details

Unlock your trading potential with the Quantum Profits Trading Course! Gain expert insights, master trading psychology, refine strategies, and build confidence with 21 dynamic modules.

- First 100 Sign-ups Get 30 Days Free Access to the Quantum Profits Trading Group (Valued at $102.50).

- Results-Based Approach to Course Creation

Money-back Guarantee

Watch the First 5 Modules and if You Don’t Like It, Get a 100% Money-back Guarantee.

Money-back Guarantee

Meet the Experts Who Will Guide and Inspire Your Journey

Paolo Tiberi

- 5,000 + books sold

- 500,000 Social Reach

- 22X in the last cycle

Paolo Tiberi has become a millionaire trading cryptos, he is a published author and an influencer in the Crypto Space. After achieving generational wealth he is now endeavouring to teach his strategies and techniques to others.

Joe Shew

Joe is the CEO and Founder of Crypto Consulting Institute, Australia and New Zealand’s No. 1 Rated crypto education company on TrustPilot and helped investors create over $56 million in profits to date and counting.

- 11 Years Crypto Experience

- Received nominations at the Australian Blockchain Industry Awards

- Community Leader of the Year

- Blockchain of the Year

- Education Company of the Year

- Featured on

- NASDAQ

- Channel 10

- Channel 9

- Dollars With Sense TV

- Bybit

- Swyftx

- Uptrade

- Crpyto Crate

- Ausbiz

Joe Shew

Joe is the CEO and Founder of Crypto Consulting Institute, Australia and New Zealand’s No. 1 Rated crypto education company on TrustPilot and helped investors create over $56 million in profits to date and counting.

- 11 Years Crypto Experience

- Received nominations at the Australian Blockchain Industry Awards

- Community Leader of the Year

- Blockchain of the Year

- Education Company of the Year

- Featured on

- NASDAQ

- Channel 10

- Channel 9

- Dollars With Sense TV

- Bybit

- Swyftx

- Uptrade

- Crypto Crate

- Ausbiz

What You'll Learn Throughout the Course

Discover my personal journey to becoming a master trader and the key takeaways that shaped my trading philosophy.

Key Topics:

- A rough 3 years, a steep learning curve

- Finding a trading methodology that was: Low stress, excitement, minimal time investment, great returns, and a skill for life

- How I became a master trader

- Eye-opening statistics: Why 94% of traders lose their money

- Answering the big question: “Are you too late to trade cryptos?”

- Overview of what people should expect.

Develop the psychological skills needed for trading success. Learn how beliefs, emotions, and perceptions influence decisions and cultivate a mindset that values process over results.

Key Topics:

- Self-awareness: A trader’s superpower

- Probabilistic thinking vs. emotional bias

- Embracing uncertainty as a trading necessity

- The Trading Pyramid: Building success with mindset, strategy, and discipline

Develop a robust risk management framework to protect your capital. Discover how to calculate position sizes, set stop-loss levels, and define risk-reward ratios for consistent profitability.

Key Topics:

- Risk per trade: balancing risk and reward

- Position sizing for different market conditions

- Avoiding over-leveraging and emotional trading

Learn how patience, strategy, and understanding market currents can lead to exceptional success rates.

Key Topics:

- Patience: The ultimate trading tool

- Reverse-engineering market maker tactics

- Understanding Market Cycles

- Using TIME as your LEVERAGE

- How wealth is transferred

- The market as a knowledge exchange

- Smart Money Vs Inexperienced Money

Learn to identify the primary trend using effective tools and techniques. Gain the skills to confirm trends and align your trades with the prevailing market direction for greater consistency.

Key Topics:

- Tools for identifying trends: Moving averages, trendlines, and volume analysis

- Differentiating between primary, secondary, and micro-trends

- Confirming trends with multiple timeframes

- Avoiding false breakouts and trend reversals

Build the mental resilience needed to stay disciplined and emotionally balanced in volatile markets. Learn techniques to maintain confidence and stick to your plan.

Key Topics:

- The 5 things to look out for Market Tops and Bottom Reversals

- Trend and Candle Anatomy

- Break of Structure (of the Trend)

- Angle of the Trend becoming wider (indicating momentum is waning)

- Fake Breakouts

- Double or Triple Tops or Bottoms

- The psychology of winning and losing trades (Overcome Assumptions)

Understand how to achieve exponential portfolio growth through disciplined compounding strategies.

Key Topics:

- The science of compounding: How small gains multiply over time

- Reinvesting profits while managing risk

- Scaling trade sizes in strong trends

- Avoiding over-leverage when compounding

Learn to identify, filter, and prioritise high-potential trades with a structured watchlist workflow.

Key Topics:

- Break of Market Structure

- Cup Structure

- Waves in the Market

- Discounted Coins

- Chart Patterns “W”, “M” etc.

- Hicks and Candle Anatomy

- Other Chart Patterns

- News, Airdrops et.

Master the art of exiting trades to lock in profits and minimise losses effectively.

Key Topics:

- Setting profit targets and trailing stop losses

- Recognising signals for trade exits

- Adjusting exit strategies based on market conditions

- Avoiding the trap of holding trades too long

Discover how to maintain a trading journal to analyze performance, identify patterns, and refine strategies.

Key Topics:

- What to include in a trading journal

- Reviewing trades for insights and improvements

- Using your journal to identify strengths and weaknesses

- Leveraging journal data for strategic adjustments

Key Topics:

- Showing behind the scenes

- Testimonials

- How to sign up

Understand what a “trading edge” is and why it’s essential for long-term success. Learn how to identify and refine your edge to ensure your trades are statistically sound, not impulsive.

Key Topics:

- What type of trader or investor are you?

- Characteristics of a trading edge, work with your personality

- Aligning strategies with your edge for better outcomes

Recognise and manage the emotional pitfalls that undermine trading success, such as fear, greed, and impatience. Learn how the market preys on inexperienced traders and how to protect yourself.

Key Topics:

- Greed, impatience, and fear: The trifecta of failure

- The psychology behind losing and winning

- Managing stress in volatile markets

- Retracements as golden opportunities

Markets evolve, and so should traders. This module focuses on adaptability and recognising when to adjust strategies in response to changing conditions.

Key Topics:

- Recognising shifts in market behaviour

- Adjusting your edge for different trading environments

- Knowing when to pause trading to recalibrate

- Overcoming “analysis paralysis”

Master market cycles and fractals to align your trades with prevailing sentiment.

Key Topics:

- BTC’s 4-year cycle and its phases

- Timeframes in market analysis

- Understanding Market Cycles and Sentiment

- Review potential Top of the Cycle

- Cycle change, Macro-Economics, ETFs etc.

Explore the power of time and trends as essential tools for trading success. Understand how aligning with macro trends can improve your trade timing and profitability.

Key Topics:

- Using time as leverage: Holding positions strategically

- Going with the flow: Adapting a Zen mindset to trading

- Avoiding the pitfalls of fighting market momentum

- The Power of Patience

- Delayed gratification and its impact on trading

- How to wait for ideal setups and confirmations

- Avoiding impulsive decisions driven by market noise

- Case studies: Success stories of patient trading

- Identifying high-probability setups within a trend

- Entry and exit strategies for trend trading

- Managing trades during trend consolidations

- Scaling into and out of trades based on trend strength

Discover the power of dollar-cost averaging (DCA) to minimise emotional stress and manage risk effectively.

Key Topics:

- When and how to use DCA in trading

- Reducing risk during market corrections with DCA

- Combining DCA with trend-following strategies

- Avoiding common mistakes with DCA entries

- Using technical analysis tools for precision entries

- Recognising optimal entry points in various market conditions

- Timing entries with support and resistance levels

- Incorporating volume and candlestick pattern

Consolidate your understanding of key trading principles and ensure you’re ready to apply them in real-world scenarios.

Key Topics:

- All markets are driven by beliefs.

- There are no certainty in the market only probabilities

- Traders enter trades assuming they’ll win—learn to challenge this bias.

- Trends reflect the consensus of buyers and sellers.

- Fundamental analysis is always reflected in price action.

- Timeframes indicate the overall trend for that period.

- Understand the belief behind the price action to gain an edge.

- Setting up criteria for watchlist inclusion

- Maintaining and updating your watchlist regularly

Apply everything you’ve learned by analysing real trades and practising in simulated environments to refine your skills.

Key Topics:

- Case studies: Real-world examples of successful trades

- Analysing and learning from trade outcomes

- Setting up simulations for practice without risk

- Identifying mistakes and improving strategies

Develop the discipline and structure needed to execute your strategies confidently and consistently.

Key Topics:

- Creating and adhering to a trading plan

- Journaling and reviewing trades for continuous improvement

- Building your “trading muscle” through frequent small trades

- Turning retracements into opportunities

- Developing a routine to keep emotions in check

- Staying focused during market turbulence

- Develop your “Sixth Sense”

Embrace the mindset and habits needed for sustained success in the ever-changing trading landscape.

Key Topics:

- Staying adaptable to market evolution

- Maintaining discipline during wins and losses

- Strategies for long-term growth and consistency

- The importance of continuous learning and self-improvement

- The Quantum Profits Copy Trading program

- Upsell into QP Trading group

- Showing results

What You'll Learn Throughout the Course

Discover my personal journey to becoming a master trader and the key takeaways that shaped my trading philosophy.

Key Topics:

- A rough 3 years, a steep learning curve

- Finding a trading methodology that was: Low stress, excitement, minimal time investment, great returns, and a skill for life

- How I became a master trader

- Eye-opening statistics: Why 94% of traders lose their money

- Answering the big question: “Are you too late to trade cryptos?”

- Overview of what people should expect.

Understand what a “trading edge” is and why it’s essential for long-term success. Learn how to identify and refine your edge to ensure your trades are statistically sound, not impulsive.

Key Topics:

- What type of trader or investor are you?

- Characteristics of a trading edge, work with your personality

- Aligning strategies with your edge for better outcomes

Develop the psychological skills needed for trading success. Learn how beliefs, emotions, and perceptions influence decisions and cultivate a mindset that values process over results.

Key Topics:

- Self-awareness: A trader’s superpower

- Probabilistic thinking vs. emotional bias

- Embracing uncertainty as a trading necessity

- The Trading Pyramid: Building success with mindset, strategy, and discipline

Recognise and manage the emotional pitfalls that undermine trading success, such as fear, greed, and impatience. Learn how the market preys on inexperienced traders and how to protect yourself.

Key Topics:

- Greed, impatience, and fear: The trifecta of failure

- The psychology behind losing and winning

- Managing stress in volatile markets

- Retracements as golden opportunities

Develop a robust risk management framework to protect your capital. Discover how to calculate position sizes, set stop-loss levels, and define risk-reward ratios for consistent profitability.

Key Topics:

- Risk per trade: balancing risk and reward

- Position sizing for different market conditions

- Avoiding over-leveraging and emotional trading

Markets evolve, and so should traders. This module focuses on adaptability and recognising when to adjust strategies in response to changing conditions.

Key Topics:

- Recognising shifts in market behaviour

- Adjusting your edge for different trading environments

- Knowing when to pause trading to recalibrate

- Overcoming “analysis paralysis”

Learn how patience, strategy, and understanding market currents can lead to exceptional success rates.

Key Topics:

- Patience: The ultimate trading tool

- Reverse-engineering market maker tactics

- Understanding Market Cycles

- Using TIME as your LEVERAGE

- How wealth is transferred

- The market as a knowledge exchange

- Smart Money Vs Inexperienced Money

Master market cycles and fractals to align your trades with prevailing sentiment.

Key Topics:

- BTC’s 4-year cycle and its phases

- Timeframes in market analysis

- Understanding Market Cycles and Sentiment

- Review potential Top of the Cycle

- Cycle change, Macro-Economics, ETFs etc.

Learn to identify the primary trend using effective tools and techniques. Gain the skills to confirm trends and align your trades with the prevailing market direction for greater consistency.

Key Topics:

- Tools for identifying trends: Moving averages, trendlines, and volume analysis

- Differentiating between primary, secondary, and micro-trends

- Confirming trends with multiple timeframes

- Avoiding false breakouts and trend reversals

Explore the power of time and trends as essential tools for trading success. Understand how aligning with macro trends can improve your trade timing and profitability.

Key Topics:

- Using time as leverage: Holding positions strategically

- Going with the flow: Adapting a Zen mindset to trading

- Avoiding the pitfalls of fighting market momentum

- The Power of Patience

- Delayed gratification and its impact on trading

- How to wait for ideal setups and confirmations

- Avoiding impulsive decisions driven by market noise

- Case studies: Success stories of patient trading

- Identifying high-probability setups within a trend

- Entry and exit strategies for trend trading

- Managing trades during trend consolidations

- Scaling into and out of trades based on trend strength

Build the mental resilience needed to stay disciplined and emotionally balanced in volatile markets. Learn techniques to maintain confidence and stick to your plan.

Key Topics:

- The 5 things to look out for Market Tops and Bottom Reversals

- Trend and Candle Anatomy

- Break of Structure (of the Trend)

- Angle of the Trend becoming wider (indicating momentum is waning)

- Fake Breakouts

- Double or Triple Tops or Bottoms

- The psychology of winning and losing trades (Overcome Assumptions)

Discover the power of dollar-cost averaging (DCA) to minimise emotional stress and manage risk effectively.

Key Topics:

- When and how to use DCA in trading

- Reducing risk during market corrections with DCA

- Combining DCA with trend-following strategies

- Avoiding common mistakes with DCA entries

- Using technical analysis tools for precision entries

- Recognising optimal entry points in various market conditions

- Timing entries with support and resistance levels

- Incorporating volume and candlestick pattern

Understand how to achieve exponential portfolio growth through disciplined compounding strategies.

Key Topics:

- The science of compounding: How small gains multiply over time

- Reinvesting profits while managing risk

- Scaling trade sizes in strong trends

- Avoiding over-leverage when compounding

Consolidate your understanding of key trading principles and ensure you’re ready to apply them in real-world scenarios.

Key Topics:

- All markets are driven by beliefs.

- There are no certainty in the market only probabilities

- Traders enter trades assuming they’ll win—learn to challenge this bias.

- Trends reflect the consensus of buyers and sellers.

- Fundamental analysis is always reflected in price action.

- Timeframes indicate the overall trend for that period.

- Understand the belief behind the price action to gain an edge.

- Setting up criteria for watchlist inclusion

- Maintaining and updating your watchlist regularly

Learn to identify, filter, and prioritise high-potential trades with a structured watchlist workflow.

Key Topics:

- Break of Market Structure

- Cup Structure

- Waves in the Market

- Discounted Coins

- Chart Patterns “W”, “M” etc.

- Hicks and Candle Anatomy

- Other Chart Patterns

- News, Airdrops et.

Apply everything you’ve learned by analysing real trades and practising in simulated environments to refine your skills.

Key Topics:

- Case studies: Real-world examples of successful trades

- Analysing and learning from trade outcomes

- Setting up simulations for practice without risk

- Identifying mistakes and improving strategies

Master the art of exiting trades to lock in profits and minimise losses effectively.

Key Topics:

- Setting profit targets and trailing stop losses

- Recognising signals for trade exits

- Adjusting exit strategies based on market conditions

- Avoiding the trap of holding trades too long

Develop the discipline and structure needed to execute your strategies confidently and consistently.

Key Topics:

- Creating and adhering to a trading plan

- Journaling and reviewing trades for continuous improvement

- Building your “trading muscle” through frequent small trades

- Turning retracements into opportunities

- Developing a routine to keep emotions in check

- Staying focused during market turbulence

- Develop your “Sixth Sense”

Discover how to maintain a trading journal to analyze performance, identify patterns, and refine strategies.

Key Topics:

- What to include in a trading journal

- Reviewing trades for insights and improvements

- Using your journal to identify strengths and weaknesses

- Leveraging journal data for strategic adjustments

Embrace the mindset and habits needed for sustained success in the ever-changing trading landscape.

Key Topics:

- Staying adaptable to market evolution

- Maintaining discipline during wins and losses

- Strategies for long-term growth and consistency

- The importance of continuous learning and self-improvement

- The Quantum Profits Copy Trading program

- Upsell into QP Trading group

- Showing results

Key Topics:

- Showing behind the scenes

- Testimonials

- How to sign up

More Testimonials

More Testimonials

Yvette

Anyone who’s a bit lost or needs some guidance with your trading, I’d encourage you to take advantage of Paolo’s wisdom and experience. Our 1:1 call this week was incredible. He has such an awesome way of breaking everything down to its simplest form, so you can understand how to refine your trading style and work with your personal goals. Keep smashing it out Paolo!

Yvette

Anyone who’s a bit lost or needs some guidance with your trading, I’d encourage you to take advantage of Paolo’s wisdom and experience. Our 1:1 call this week was incredible. He has such an awesome way of breaking everything down to its simplest form, so you can understand how to refine your trading style and work with your personal goals. Keep smashing it out Paolo!

Ben

Ben

Russel

I had a call with Paolo on Tuesday. He filled in the knowledge gaps I had and helped me understand how to use his method to identify my own trades. So valuable. Thanks @quantumprofits!

Russel

I had a call with Paolo on Tuesday. He filled in the knowledge gaps I had and helped me understand how to use his method to identify my own trades. So valuable. Thanks @quantumprofits!

Frequently Asked Question

Around 8 to 10 Hours We recommend committing to 30 minutes a day, five days a week, to create consistent habits that will help you transition into trading.

No. This is designed in an easy to understand an action way. It is preferable that you have some prior understanding placing trades via an exchange.

Around 8 to 10 Hours We recommend committing to 30 minutes a day, five days a week, to create consistent habits that will help you transition into trading.

Participants can progress at their own pace, gaining actionable insights. The first 100 to sign up get one month of exclusive access to the Quantum Profits Trading Group, where Paolo will release the videos.